- Education

- Result

- Routine

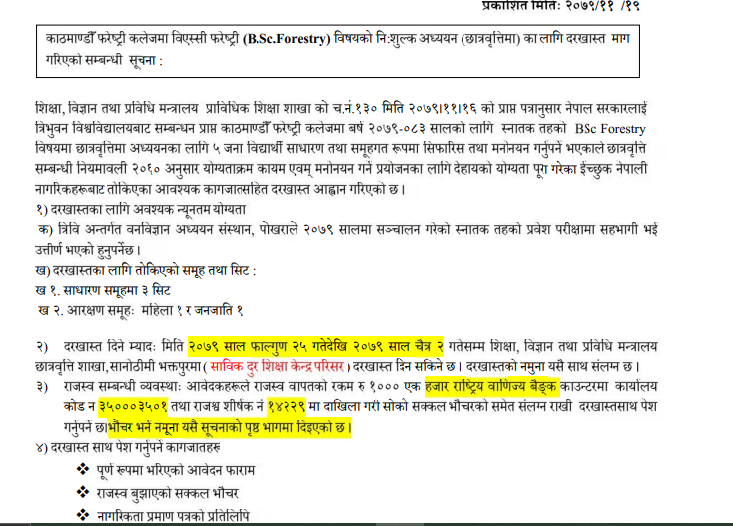

- Scholarship

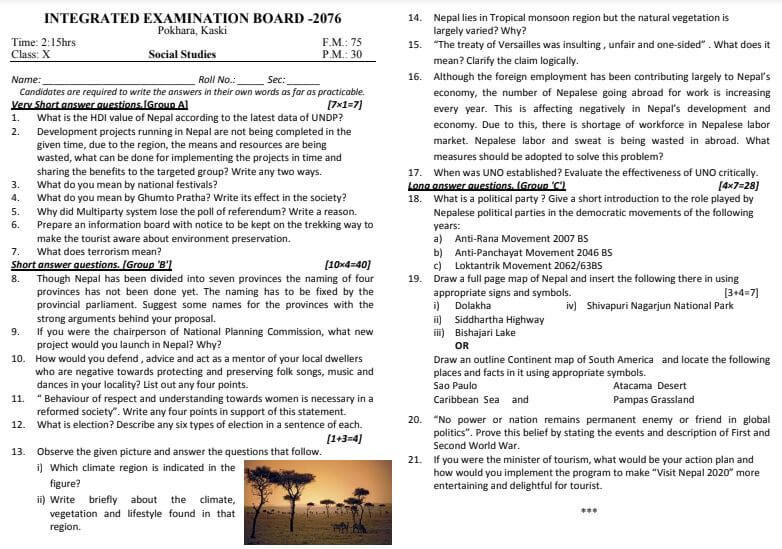

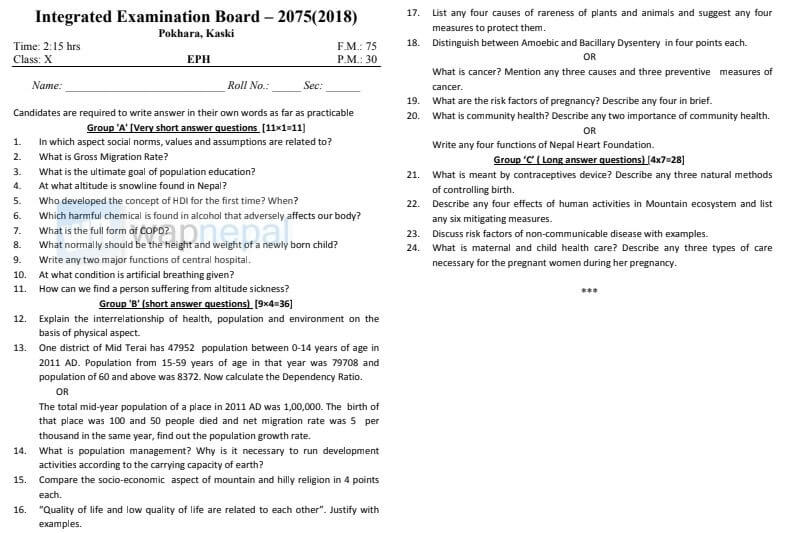

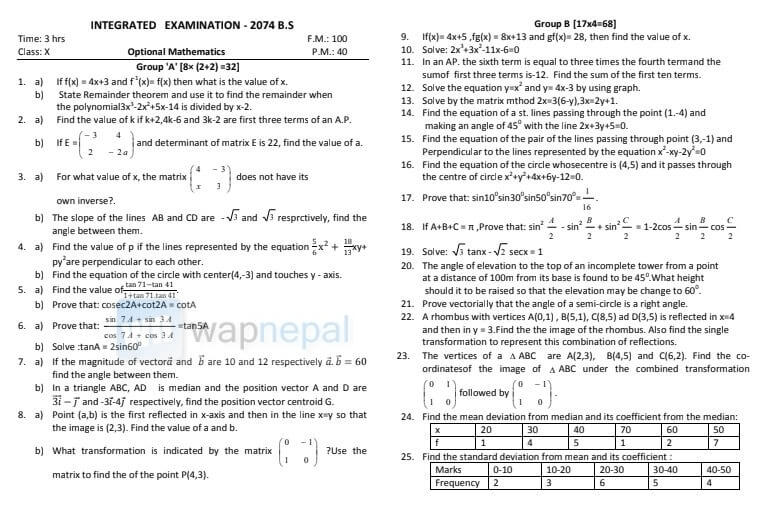

- Model Questions

NEB Class 12 Exam Routine 2081 BS for All Subjects & Faculties

National Examination Board (NEB) has recently published the new exam routine for the class 12...

BBS 1st Year Result with Marksheet Check TU First Year BBS

The expected date for the declaration of the BBS 1st Year Result 2080 with Marksheet is nearing....

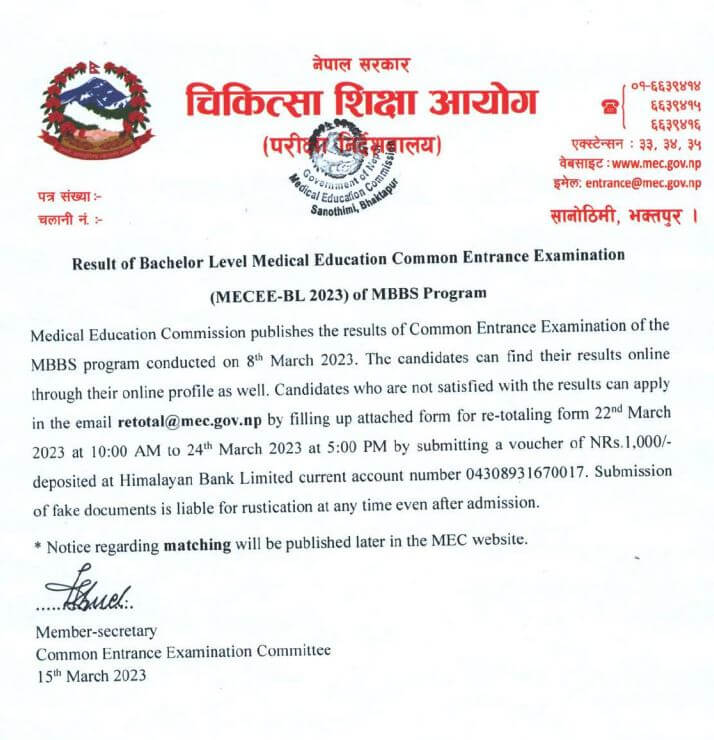

Medical Common Entrance Examination Notice 2080 2023

Medical Entrance Exam Notice 2080: The notice invites eligible candidates to apply online for the...

Kathmandu Metropolitan City Class 11 Scholarship Exam Result

On April 20, 2080, a scholarship examination was conducted from 11.00 am to 1.00 pm in order to...

Teacher Service Commission Syllabus and Model Question Download

We already discussed about TSC Nepal and two ways to check Teacher Service Commission Nepal exam...

Update

LatestPowering the Future: Exploring the Rise of Electric Cars in Nepal

In the mountainous nation of Nepal, a quiet revolution is taking place on the roads. Electric...

Price in Nepal

LatestPoco Mobile Price in Nepal

Poco Mobile, a subsidiary of Xiaomi, is a popular mobile phone brand in Nepal. The smartphones are...

All

LatestNEB Class 12 Exam Routine 2081 BS for All Subjects & Faculties

National Examination Board (NEB) has recently published the new exam routine for the class 12...

- Tribhuvan University

- Kathmandu University

- Pokhara University

- Purbanchal University

BBS 1st Year Result with Marksheet Check TU First Year BBS

The expected date for the declaration of the BBS 1st Year Result 2080 with Marksheet is nearing....

Dental Colleges in Nepal | TU KU CTEVT Nepal Dental Colleges

Dental colleges in Nepal provides different courses and degree. In this article, we are going to...

Pokhara University Admission BE Engineering program 2023

Notice: Pokhara University Admission is open for undergraduate Engineering programs for the year...

Purbanchal University Affiliated Colleges

Purbanchal University, established in 1993, is one of the premier and largest universities in...

- Lok Sewa Aayog

- Jobs

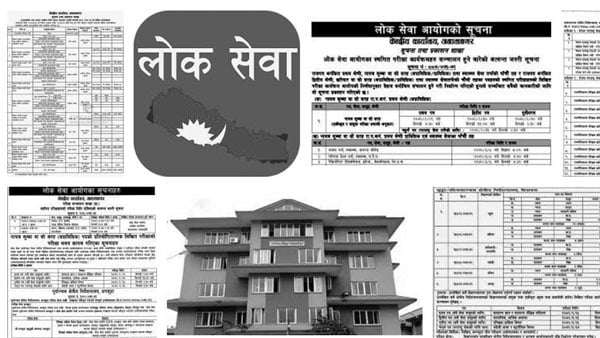

www PSC Gov Np Result Lok Sewa Aayog Result Nepal

Public service Commission (www PSC Gov Np result) in an independent government commission that...

Best Job portals in Nepal

Our previous articles were also dedicated to job searches in Nepal. I have continued the same...

All

LatestNepal Army Salary Scale Rank-wise Benefits & Allowances

The Nepal Army, also known as the Gorkhali Army, is the land service branch of the Nepalese Armed...