Nepal Rastra Bank (NRB) is the Central Bank of Nepal. Under the Nepal Rastra Bank Act, 1955, it was established to discharge the central banking responsibilities including guiding the development of the embryonic domestic financial sector.

Table of Contents

Nepal Rastra Bank formulates necessary monetary and foreign exchange policies to maintain the stability in price and consolidate the balance of payments for sustainable development of the economy of Nepal.

Nepal Rastra Bank develops a secure, healthy and efficient system of payments. It also makes appropriate supervision of the banking and financial system in order to maintain its stability and foster its healthy development.

It enhances public confidence in Nepal’s entire banking and financial system. The vision of Nepal Rastra Bank is to become a modern, dynamic, credible, and effective Central Bank.

The main mission of Nepal Rastra Bank is to maintain macroeconomic stability through sound and effective monetary, foreign exchange and financial sector policies.

Why NRB sets foreign Exchange rate

The foreign exchange rate is the mechanism by which the currency of one country gets converted into the currency of another country. The conversion rate of the currency is determined by Nepal Rastra Bank as it deals with foreign exchange.

Only Nepal Rastra Bank has the authority of determining the foreign exchange rate in Nepal as it is the central bank of Nepal.

Nepal Rastra Bank (NRB) is the central bank of Nepal. The central office of NRB is in Baluwatar, Kathmandu and operates through branches all over the Nation. NRB was established in 1956 and operates under Nepal Rastra bank act 1955. NRB is the regulatory and supervisory organ for all the banks and financial institutions in Nepal, this is called the Bank of banks.

The major objectives of NRB are to reduce unemployment, maintain the balance of payment stability, controlling inflation and ensure quality financial services. NRB directly doesn’t directly provide banking service to the general public but thorough check and control of other banks, it ensures quality service and apart from that, the major function of NRB is to maintain exchange rates.

One of the most important functions of NRB is to maintain exchange rates. Today 110 Nepali rupees equals one US dollars. The value of Nepali currency is very low in the world scenario and different factors are responsible for this. Inflation rates, interest rates, export and import ratio, political scenario, government debt are some of the determinants of exchange rates.

Nepal rastra bank provides daily Nepal exchange rates of foreign currencies. For getting exchange rate details, you need to log in to www.nrb.org.np. In the rightmost section, you will see Foreign Exchange Rates. This section provides information about the exchange rate. This Nepal exchange rate section is updated daily. Nepal rastra bank is only the governing body to manage the Nepal exchange rate of Nepal.

Nepal Rastra Bank sets the currency exchange rate daily. The Exchange rate is updated and it changes daily. NRB sets all exchange rate for dollar- USD, AUD, SGD, GBP, INR.

If you are checking the exchange rate of a specific date, you can also do it. nrb.org.np provides service for knowing Nepal exchange rate of previous dates too. You can select your specific date on the drop-down menu available on that page. You can get the exchange rate of all currencies.

If you are abroad, you can send money when the exchange rate is higher. You will get a higher amount in Nepal. If your family members are abroad, you can ask them to send money when the exchange rate is higher. It will be a great benefit for you.

Nepal Rastra Bank manages all banks in Nepal and provides daily Nepal exchange rates for foreign currency. Nepal rastra bank is dedicated to developing a secure, healthy and efficient payment system in Nepal. It supervises banks and financial companies to maintain their stability. Nepal Rastra Bank is constantly dedicated to the financial development of Nepal.

NRB was established in 1956 under the NRB act 1955. It has its central office in Baluwatar, Kathmandu, and branches all over the Nation. NRB supervises and regulates all the banks and financial institutions of Nepal, this is called the Bank of banks. The major objectives of NRB are to control inflation, reduce unemployment, maintain the balance of payment stability, foreign exchange policy formulation and ensure quality financial services.

How to check Nepal Rastra Bank Exchange Rate

Step 1: In order to see or check the Nepal Rastra Bank foreign exchange rate you need to visit this link https://www.nrb.org.np/. After clicking in this link you are then directed to the official page of Nepal Rastra Bank.

Step 2: As seen in the picture here you can see the foreign exchange rate at the top right side of the page.

There are exchange rates in some countries. You can also see More… Options click on the more button or click on this link https://www.nrb.org.np/forex to check the rates of other countries.

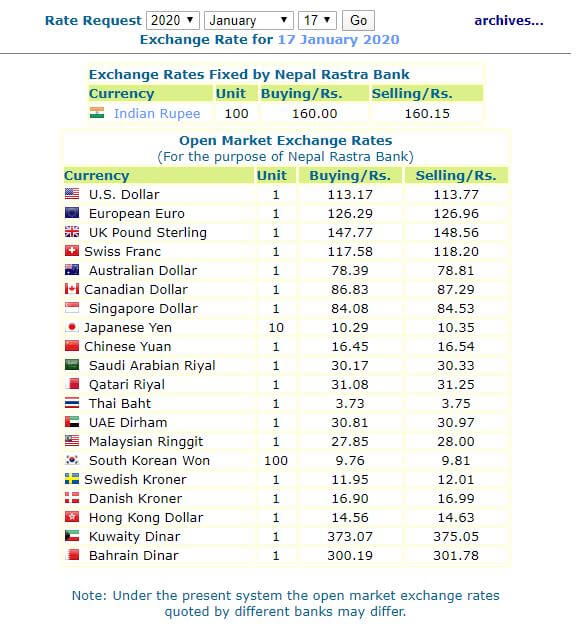

Step 4: After clicking on the button or the link you will be directed to the foreign exchange rate. You can see the exchange rate according to the date. You can also see the buying and selling rate by the Rastra Bank.

The exchange rate is changing from time to time so in order to know the current exchange rate, you need to refresh this link which shows the current exchange rate.

A country with a consistently lower inflation rate exhibits a rising currency value, as its purchasing power increases relative to other currencies. Since the inflation rate is very high in Nepal there is no doubt that our currency stays so much behind. Lower the interest rates higher will be the currency value. Increases in interest rates cause a country’s currency to appreciate because higher interest rates provide higher rates to lenders, thereby attracting more foreign capital, which causes a rise in exchange rates.

Similarly, a country’s current account reflects the balance of trade and earnings on foreign investment. It consists of a total number of transactions including its exports, imports, debt, etc. The current account shows the art of foreign exchange. A country with government debt is less likely to acquire foreign capital, leading to inflation. Foreign investors will sell their bonds in the open market if the market predicts government debt within a certain country. As a result, a decrease in the value of its exchange rate will follow.

Government debt is high in Nepal resulting in fewer exchange rates. The country’s political state and economic performance can affect its currency strength. A country with less risk for political issues is more attractive to foreign investors. An increase in foreign capital, in turn, leads to an appreciation in the value of its domestic currency. But of course, looking at the political and economic condition of the country there is no doubt that we have so less foreign direct investments and a weak currency.

How to check old exchange rate from NRB website

Step 5: On this page, there is an option of archives which is the link that directs you to change of the rate of buying and selling foreign currencies of companies. Click on the archives button then it will direct you to another page.

Here you can see the change in the buying and selling price of currencies. By changing the date and clicking on the button show it will show the change in the selling and buy price of currencies of different countries in those days you mentioned and it calculates the average rate. It helps you to understand the change in the exchange rate of different countries.

Nepal Rastra Bank (NRB) also monitors each and every bank of Nepal. You can also see the top 10 Nepal Banks with Contact details Interest rates. Nepal Rastra Bank (NRB) also monitors payment gateways of Nepal like Esewa.

In this article, I am enlisting a way to check foreign exchange rates. The foreign exchange rates are published by NRB itself. You can visit the official website of NRB to find out the exchange rates.

The exchange rate for 17th January 2020, today is listed here as:

| Currency | Unit | Buying price | Selling price |

| Kuwaiti Dinar | 1 | 362.61 | 364.59 |

| Bahrain Dinar | 1 | 289.73 | 291.32 |

| UK Pound Sterling | 1 | 144.39 | 145.18 |

| European Euro | 1 | 127.71 | 128.41 |

| Swiss Franc | 1 | 110.50 | 111.10 |

| US Dollar | 1 | 109.78 | 110.38 |

| Canadian Dollar | 1 | 83.31 | 83.77 |

| Australian Dollar | 10 | 80.78 | 81.22 |

| Singapore Dollar | 1 | 80.26 | 80.70 |

| UAE dirham | 1 | 29.89 | 30.05 |

| Saudi Arabian Riyal | 1 | 29.27 | 29.43 |

| Qatari Riyal | 1 | 30.13 | 30.30 |

| UAE Dirham | 1 | 29.89 | 30.05 |

| Malaysian Ringgit | 1 | 27.17 | 27.32 |

| Danish kroner | 1 | 17.14 | 17.23 |

| Chinese Yuan | 1 | 16.48 | 16.57 |

| Hong Kong Dollar | 1 | 13.99 | 14.07 |

| Swedish Kroner | 1 | 12.23 | `12.30 |

| Thai Baht | 1 | 3.31 | 3.33 |

| Japanese yen | 10 | 9.91 | 9.96 |

| South Korean Won | 100 | 9.81 | 9.86 |

The foreign exchange rate changes quite a bit frequently. For more information, please stay updated with us. In the coming days, we will have other articles for your information.

Factors affecting exchange rates

A country with a continuously lower inflation rate has higher purchasing power making its currency powerful than others. Lower the inflation rate higher will be foreign exchange value. Since the inflation rate is very high in Nepal there is no doubt that our currency stays so much behind. The inflation rate in Nepal is always increasing and this applies to all kinds of goods.

Similarly, interest rates have a huge impact on foreign exchange rate determination. Lower the interest rates higher will be the currency value. Increases in interest rates cause a country’s currency to appreciate because higher interest rates provide higher rates to lenders, thereby attracting more foreign capital, which causes a rise in exchange rates. This is all about attracting foreign direct or indirect investment in Nepal. But the level of FDI is very low in the case of Nepal. The scenario is not favorable for Foreign investment.

Why NRS depends upon INR

India has always been very close to the Nepalese economy. Every other activity in India directly influences the economy of Nepal. Nepal is highly dependent on India for trade and other major activities. In such a case, it is obvious that our exchange rates depend heavily on India. We import a lot from India and our export is very less. This has caused deficit Balance of trade which is one of the reasons behind less foreign exchange rates. No just trade relations India has always interfered in the private matters of Nepal. This is also because we are weak in terms of economy, political stability and prosperity.

Nepali currency is not the most expensive in the world. This is because of our own pace of development. The world is reaching new heights and we are still struggling for the fulfillment of basic needs. There are not many manufacturing industries. We heavily depend on neighboring countries for getting day to day basic supplies. The export is very less compared to import. With so many issues the currency is definitely one of the most less powerful. NRB has an important role in managing exchange rates but when he determinants of exchange rates are overlooked by the government there is no chance for an increase in the value of the currency.

Nepal Rastra Bank Important Notice

- Nepal rastra bank requests all to send their money through bank or remittance. Hundi is illegal. So, do send through bank or remittance.

- Deposit saving amount in the bank.

- National paper notes (currency notes) are our income. Let’s use it wisely.

- Exchange foreign currency only from Nepal rastra bank authorized ex-changers. Buying selling foreign currency is illegal.

- Notices of “winning lottery” or “You have received money” in your SMS or email may be a fraud. So stay clever from being bankrupt.

- Let’s discourage unnecessary expenses. Let’s make the habit of saving money. Saving money is only the way to revenue progress.

- If you are doing banking transactions, make a habit to learn terms and conditions, interest rates, loan rates and base rate of the bank.